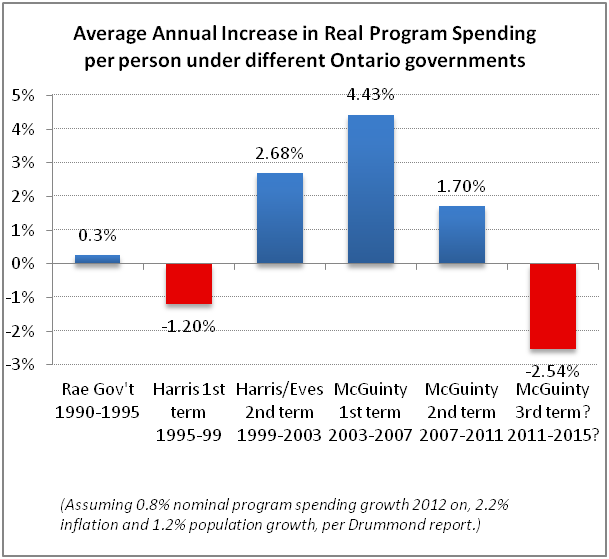

If Ontario proceeds with Drummond’s austerity recommendations, cuts to program spending under McGuinty’s third term will be twice as deep than the first term of Mike Harris.

This would not only be extremely unfair, hurting middle and lower income families the most; it could also easily thrust Ontario’s economy back into a recession.

It doesn’t need to be this way. If the McGuinty government wants to balance the budget, it should do it in a balanced way, with constraints on public spending matched with progressive revenue increases.

CUPE’s “Austerity Doesn’t Work” document shows Ontario can balance its budget while improving public services by implementing just a few fair tax measures.

Despite the spending cuts of the 1990s, the Canadian economy was able to grow at that time because of monetary stimulus: interest rates were cut in half. There’s no opportunity for that now: interest rates are at rock-bottom levels and will be rising.

Drummond’s forecasts for Ontario economic growth are pessimistic and exaggerate Ontario’s deficit situation. However, they could become self-fulfilling if they lead to the levels of cuts he proposes. Spending cuts will cause major damage to the Ontario economy, and could easily plunge it back into recession.

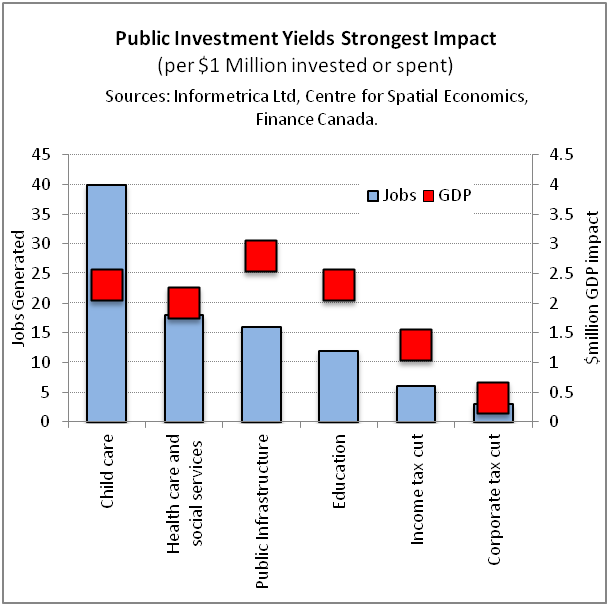

Public spending cuts will cause much greater damage to Ontario’s economy than revenue increases (see chart below). Premier McGuinty’s promise to rely solely on spending cuts to balance Ontario’s budget is economically misguided and socially unjust. Even former federal Liberal Finance Minister Paul Martin’s deficit cutting strategy in the 1990s included some balance of revenue increases with spending cuts.

Cuts to public services will especially hurt lower and middle income families in Ontario, who depend more on public services, thereby increasing inequality and creating greater economic instability.

Instead of cutting program spending, the Ontario government should invest in public services at a reasonable level to ensure the economy continues to grow. Ontario’s spending is not out of control. Ontario has lower program spending per person than most other provinces.

Salaries and wages in Ontario’s public sector are comparable to the private sector for similar occupations. In fact, wages for Ontario public sector workers only recently recovered to the real value they had been in 1990.

A small number of progressive fair tax measures could generate approximately $10 billion a year for the Ontario government.

|

Fair and Progressive Revenue Options |

|

|

Revenue measure |

Annual Revenues (billions) |

|

Fair taxes for corporations |

|

|

Restore corporate income tax rate to 14% |

$2.5 |

|

Restore corporate capital tax |

$1.8 |

|

Financial transactions tax at 0.1% |

$1.0 |

|

Progressive tax on high incomes |

|

|

Hike Ontario’s income tax rate on incomes over $500,000 by two percentage points to 13.16% |

$0.5 |

|

Close tax loopholes |

|

|

Eliminate tax preferences for stock options and capital gains |

$1.5 |

|

Eliminate Employer Health Tax exemption for small business |

$2.4 |

|

Total |

$9.7 |

|

Sources:Drummond report Table 11.1, p. 303); Ontario Transparency in Taxation 2011; Fair Shares: How Banks, Brokers and the Financial Industry Can Pay Fairer Taxes, CCPA 2011; Hugh Mackenzie analysis for Ontario Health Coalition. |

|

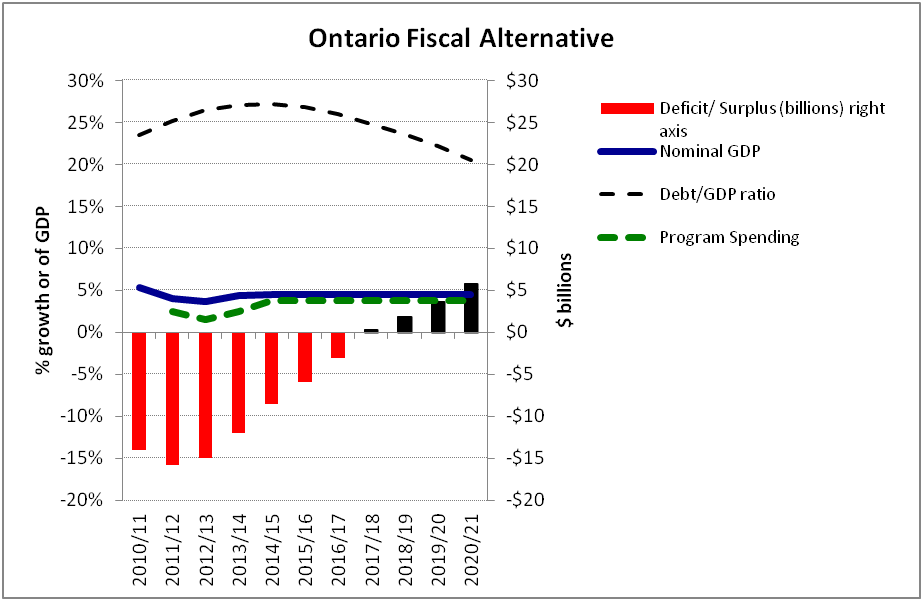

Ontario could balance its budget by 2017/18 and maintain reasonable rates of growth in public spending if it introduced a number of progressive fair tax measures at a measured pace.