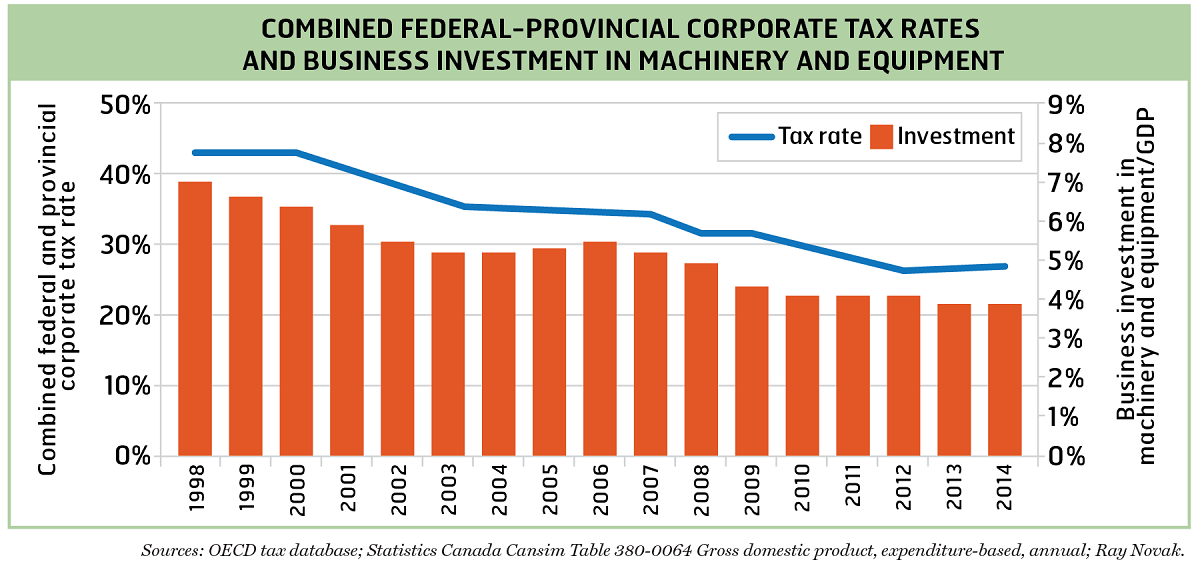

The overall general tax rate applying to corporate income/profits in Canada was slashed from 42.9 per cent in 1999 to 26.3 per cent in 2014 (see chart). The effective tax rate paid by corporations is even lower than this and has been cut by a similar degree.

These corporate tax cuts have largely occurred at the federal level, with the federal corporate income tax rate almost halved from 29.2 per cent in 1999 down to 15 per cent now, but many provinces have also cut corporate tax rates. In addition taxes on corporate capital, capital gains taxes, business property taxes and sales taxes applying to business have also been reduced or eliminated.

Meanwhile there’s been no reduction in personal income tax rates under Harper. This year corporate income taxes now contribute just 12.7 per cent of every dollar in federal revenues, down from 16.5 per cent in 2006/7, representing a decline in federal revenues of $11 billion. Meanwhile personal income taxes now provide 49.4 per cent of all federal revenues, up from 46.4 per cent when Harper was first elected, representing an increase of about $9 billion.

Liberal and Conservative politicians from Paul Martin to Stephen Harper said that these cuts to corporate taxes would lead to an increase in business investment and thereby increasing employment and economic growth.

The clear evidence shows that this has not happened. Instead, we’ve seen a decline in the share of business investment as a share of the economy. It’s a multi-multi-billion experiment that has failed and should be reversed.

The federal tax rate for corporate income is now only 15 per cent, almost half the top rate of 29 per cent that individual Canadians pay on their income from working. This makes it very lucrative for higher income individuals to shift their income through corporations to reduce their taxes. This type of tax shifting may create jobs for accountants and tax lawyers, but it isn’t good for the economy. The lower tax rate costs the federal government over $10 billion annually in lower revenues.

Corporate tax cuts are also a very ineffective way to create jobs. Finance Canada estimates that public investment in infrastructure, housing and other areas generates five times the number of jobs and five times the economic stimulus as the same amount in corporate tax cuts. This is even truer now with Canadian corporations sitting on more than $600 billion surplus cash they aren’t investing in growing the economy. It makes far more sense for the federal government to increase corporate tax rates, using the funds raised to invest in the economy and improve public services.