The federal government may soon register a surplus, but its tax loopholes are shortchanging the provinces of billions.

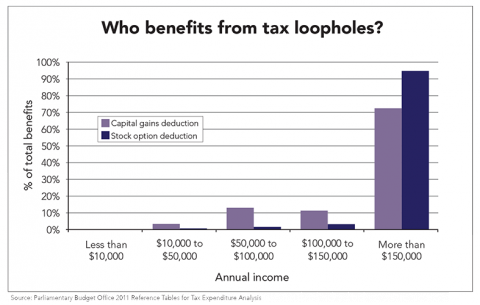

The stock option deduction loophole, that allows executives to pay half the rate of tax on income from stock options, cost the federal government an estimated $785 million in 2012. And because all provinces except Quebec base their personal income tax rates on the federal calculation of taxable income, it also meant provinces lost about $370 million too.

Heard enough? Sorry, it gets worse.

Taxing capital gains income at half the rate of employment income cost the federal government $4 billion in 2012, but also meant $2 billion in lower revenues for the provinces. Other federal tax loopholes cost provinces billions more.

Provincial governments aren’t blameless. Many have cut taxes for wealthy people and created loopholes of their own for personal and corporate taxes. They could introduce surtaxes to compensate for these loopholes too, but those would make the tax system more complicated and fragmented.

The best solution is for the federal government to lay off on criticism of provincial deficits they helped create, close the loopholes, and tax capital income at the same rate as labour income.