New Long-term Infrastructure Plan provides more flexibility but less funding…

The biggest and one of the most anxiously awaited announcements in the 2013 Federal Budget was the new long-term infrastructure program to replace the seven year Building Canada program set to expire March 2014.

As was widely anticipated, the federal government committed to a new program, but with funding considerably less than what the Federation of Canadian Municipalities and its partners through the Municipal Infrastructure Forum (including CUPE), had called for.

Budget 2013 announced:

-

Renewal of Building Canada Fund (BCF) starting in 2014/15, but at an average of $1 billion per year for provinces and municipalities over 10 years, down from $1.25 billion annual average of the previous BCF. This funding is back-end loaded, with less than $200 million per year for the first two years. Funding allotments are to be announced shortly and will include base funding for each province and territory. Funds will be able to be used for a broader range of infrastructure categories including water, wastewater, public transit and advanced research at post-secondary institutions (but not for hospitals or health care).

-

Funding of $4 billion over 10 years for a new National Infrastructure Component of the BCF for “projects of national significance, particularly those that support job creation, economic growth and productivity.” This funding is to be allocated on a merit basis but is also back-end loaded with only $15 million allotted for each of the first two years. This replaces and supplements funding previously provided through different programs.

- The Gas Tax Fund and GST Rebate for Municipalities will be repackaged into a “Community Improvement Fund”. The budget responded to a long-standing request of the FCM and will index the $2 billion Gas Tax Fund to inflation of two per cent annually, to be applied in $100 million increments. Municipalities will also be able to use these funds for a much broader range of infrastructure projects, covering virtually all areas of municipal infrastructure and, for the GST, to also include maintenance and operations.

There will be a review of the Building Canada Fund after five years by the end of 2018/19 to ensure objectives are being met. This could lead to increased funding at that time—depending on who is in government.

…involves a greater role for Public Private Partnerships

-

Renewal of $1.25 billion in funding for the P3 Canada Fund, but for five years instead of the previous seven, which amounts to an increase in the average annual allotment.

-

Requirement of a P3 screen for all projects funded under the Building Canada Fund with a total capital cost of over $100 million. Initially, projects that involved a federal contribution of $50 million under the original BCF required consideration as a P3, but this was suspended as part of the Economic Action Program to speed up project delivery. As federal contributions can be one-third of capital costs, this new requirement may lower the effective threshold. If “rigorous analysis” shows a project can be successfully delivered as a P3 and generate positive value for money, P3 procurement will be a condition of federal funding. PPP Canada will “play a key role in supporting the application of the P3 screen,” with further details on the application of the screen to be announced later.

- Funding of $10 million from P3 Canada Fund to cover up to 50% of the costs of procurement options assessment as P3s by municipalities, provinces and territories, to a maximum of $200,000 per project. This funding provision is new and responds in part to concerns expressed by municipalities about the high cost of considering P3s.

…gets Mixed Reviews

Despite the reduction in annual funding from current levels, the Federation of Canadian Municipalities responded positively to the budget announcement. Positive aspects included the ten year commitment, indexing of the gas tax fund, predictability, increased flexibility, funding (albeit limited) for capacity building, and not tying all funding to P3s.

Some prominent mayors were less enthusiastic in their reactions, describing it as a good start, and also criticizing the ideology and red tape costs required as a result of the P3 screen. CUPE and others were critical about support for P3s and that federal funding for infrastructure will be cut from existing levels.

The FCM and its partners in the Municipal Infrastructure Forum had called for the Long Term Infrastructure Program to have a 15-20 year commitment with annual funding of $5.75 billion:

-

Renewed funding of $2 billion through the Gas Tax Fund, to be indexed at three percent.

-

Renewed funding of $1.25 billion for the Building Canada Fund, indexed at three percent.

- An additional $2.5 billion annually through a new Core Economic Infrastructure Fund.

Instead of the $5.75 billion requested, Budget 2013 provides funds averaging $3 billion for municipalities and provinces, an average of $250 million less than is currently allotted under the Building Canada Fund and the Gas Tax Fund.

CUPE also called for elimination of the P3 Fund and of PPP Canada, for the government to stop forcing municipalities to undertake costly P3s, and for more federal funding to be devoted to public transit and sustainable infrastructure to help Canada reach its carbon reduction goals

What it means

On the surface, renewal of the Building Canada Fund is a good thing, but it is significantly less than what had been requested, involves a cut in funding from current levels and much of the funding is back-end loaded: with only 3 per cent of the BCF allocated for the first two years of the program with 74 percent allotted for the last half of the program.

The National Infrastructure Fund component may seem like a funding boost, but it combines spending from a number of other programs for “projects of national significance” including highways, public transit, gateway and trade corridor related infrastructure, disaster mitigation infrastructure and First Nations infrastructure. This component will provide the federal government with the flexibility to undertake projects that could give it significant profile. We can expect to see Ottawa play more of the role of economic nation builder than just writer of cheques. The packaging of the Gas Tax Fund and the GST Rebate for Municipalities into a Community Improvement Fund may also have been done to give the federal government more profile for these transfers, which has been a long-standing concern for them.

By increasing the annual budget for the P3 Canada Fund while reducing and back-end loading funding for the Building Canada Fund, the federal government is undoubtedly trying to push municipalities into undertaking public private partnerships instead of more cost-effective public financing, operation, maintenance and delivery.

Analysis of the comparative costs of procurement options through P3 screens in Canada is far from transparent and extraordinarily biased towards P3s. Both P3 agencies and accounting firms use creative accounting to make P3s look less expensive than traditional procurement. This is leading to increased privatization, P3 failures and a growing mountain of liabilities—a P3 debt bomb—imposed on future governments and taxpayers. CUPE has developed a guide for municipalities considering P3s, Asking the Right Questions to assist officials—but the real financial impacts are rarely disclosed through these P3 screens. The federal NDP has also called for greater transparency and accountability in relation to P3s.

Funding of $155 million over ten years allocated from the Building Canada Fund for infrastructure projects on First Nations Reserves (only $15 million per year) will be combined with funding from the Gas Tax Fund in the First Nations Infrastructure Fund. This fund will continue to focus on the same priority areas as before: energy systems, telecommunications connectivity, roads and bridges, solid waste and capacity building, with funding for First Nations water and housing provided elsewhere. Budget 2013 states that the level of funding for this fund will be at least equivalent to the amounts allocated under the 2007 Building Canada Fund. This amounted to a total of $234 million from 2007 to 2013, which remains far below these significant infrastructure needs on reserves across Canada.

While the federal government’s commitment of long-term funding for infrastructure is welcomed, the amounts provided in this budget fall well short of the amounts requested by the Federation of Canadian Municipalities and are even less than existing levels. Moreover they are inadequate to significantly reduce the $120 billion infrastructure deficit or to meet the infrastructure needs of Canadian communities. Municipalities will face greater pressure to provide necessary services without adequate support of the level of government with the greatest share of revenue.

Since municipalities are responsible for building, repairing and maintaining 60 per cent of Canada’s infrastructure, but are largely restricted to regressive property taxes and user fees that provide only 8 per cent of every tax dollar, we can expect they will renew their push for greater access to new revenue sources from provincial and federal governments. Access to new revenue sources would provide municipalities with greater independence, with more funds for maintenance and without being forced into P3s, but it will be important to ensure these are progressive and don’t fall unfairly on lower and middle income Canadians.

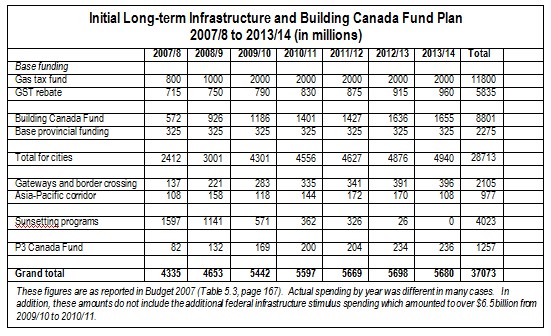

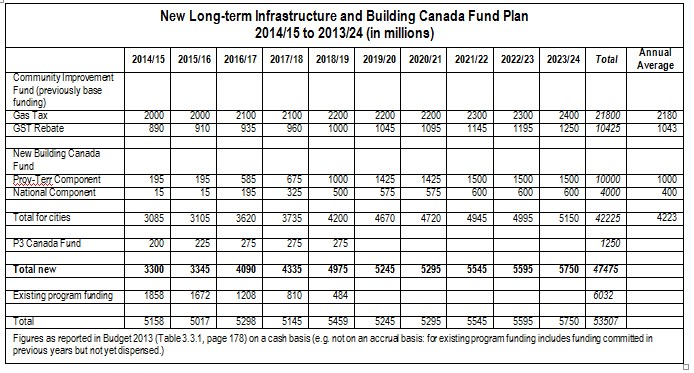

Federal Funding for Infrastructure under the Initial and New Long Term Infrastructure Plans