|

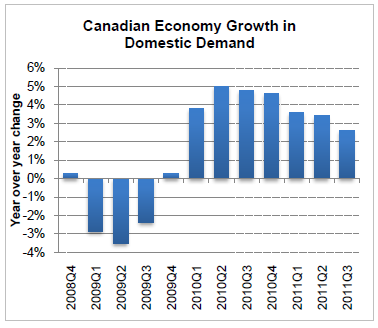

Economic Outlook Summary Canada’s economy grew during the third quarter, but it was on the back of higher exports. Our domestic economy is sharply slowing down with job losses and declines in real wages. Austerity measures and the Euro crisis are throwing many European countries back into recession. In the United States, the expiry of existing stimulus measures and Republican refusal for anything new will curtail demand there. At home, overvalued house prices, record levels of household debt and government cutbacks are casting darker clouds on our domestic economy. Private economic forecasts now expect:

|

Rising inequality hurting our economy

Income inequality in Canada is not only worse than average; it’s been getting worse faster. It’s also a fundamental problem making our economy weaker. Now even business-friendly organizations agree with Warren Buffett and the Occupy movement: trickle-down economics doesn’t work. The solutions aren’t complicated: we just need our political leaders to listen—and act.

Labour rights, unions and the 99%

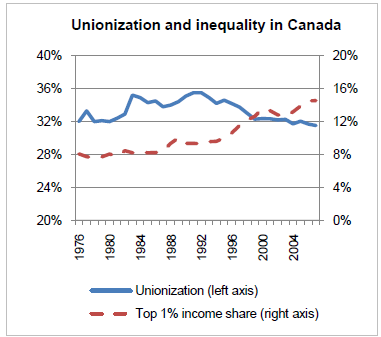

The fight over labour rights is escalating in Canada with governments intervening in collective bargaining and trying to restrict the power of unions. This comes at a time when inequality in Canada is getting worse. There’s a clear relationship between unionization and equality. When rates of unionization increase, equality increases and when unionization declines, inequality gets worse – and the share going to the top 1% rises.

Canadian economy bleeding jobs; public sector cuts to intensify

Job losses continued in the past two months. More public sector job cuts are planned at federal, provincial and local government levels, which will keep unemployment high.

Recession and cuts hit Aboriginal and racialized workers hardest

The recession and public sector cutbacks are hitting Aboriginal people and racialized workers hardest. Further cuts will make the situation even worse for groups who are discriminated against and already have lower incomes, higher unemployment and higher rates of poverty than average. Now there’s an opportunity to ensure that future infrastructure programs address equality concerns.

Real wages set to decline by most since 1995

Weighted down by lower public sector wage increases, real wages for Canadian workers are set to decline by the most since 1995.

The Economic Climate for Bargaining is published four times a year by the Canadian Union of Public Employees. Please contact Toby Sanger (tsanger@cupe.ca) with corrections, questions, suggestions or contributions.

Rising inequality hurting our economy

Canada’s economy is no oasis of stability in an increasingly turbulent world.

While the crisis in Europe and political clashes in the United States capture the headlines, we are experiencing mounting economic weaknesses at home.

Job growth together with real wages has turned negative: not a good sign when consumer spending accounts for two-thirds of the economy. Canada’s housing markets remain overvalued: when a correction occurs, it will compound the perilous state of household finances.

Governments at all levels are cutting spending and planning further job cuts. This will increase unemployment and slow the economy. It’s no wonder businesses are investing so little of their profits back into the economy.

After the type of financial crises we’ve gone through, economic growth and employment growth tend to remain slower than normal for years. But there’s nothing inevitable about the situation we’re in.

Growing inequality and imbalances in our economy are fundamental problems that helped cause the crisis. Income inequality in Canada is not only worse than average, it’s been getting worse faster. Unless these are fixed, we’ll all continue to suffer.

We’ve been saying it for years: inequality isn’t just unfair; it’s bad for the economy. Now even normally business-friendly organizations, including the International Monetary Fund, (IMF) the Conference Board of Canada, and most recently the Organization for Economic Cooperation and Development (OECD) agree with Warren Buffett and the Occupy movement: trickle-down economics doesn’t work. It’s time for our political leaders to listen—and act.

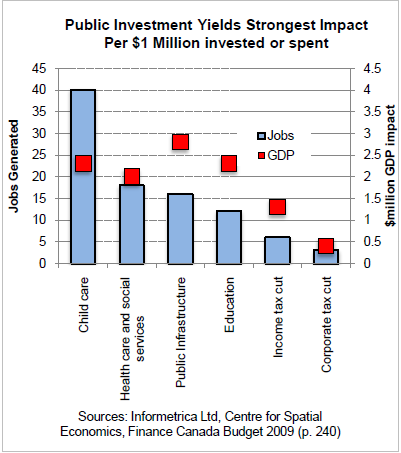

The solutions aren’t complicated. We need progressive tax changes so the wealthy and corporations pay their fair share. We need increased public investment and spending on public services and social supports to boost the economy, create jobs, and improve living standards. Governments need to work in collaboration with business, educators and labour to create a more innovative, productive and green economy. We also need regulatory changes to better control capital and to strengthen the bargaining power of workers so real wages can increase and provide sharing of productivity gains.

Economic outlook for 2012 – main points

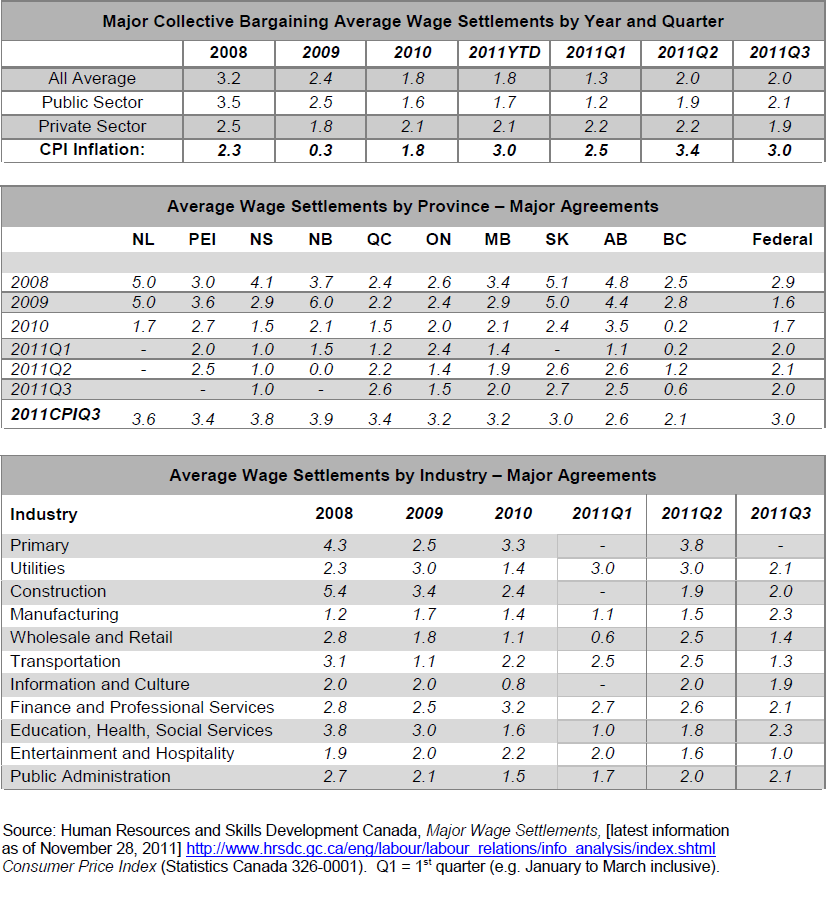

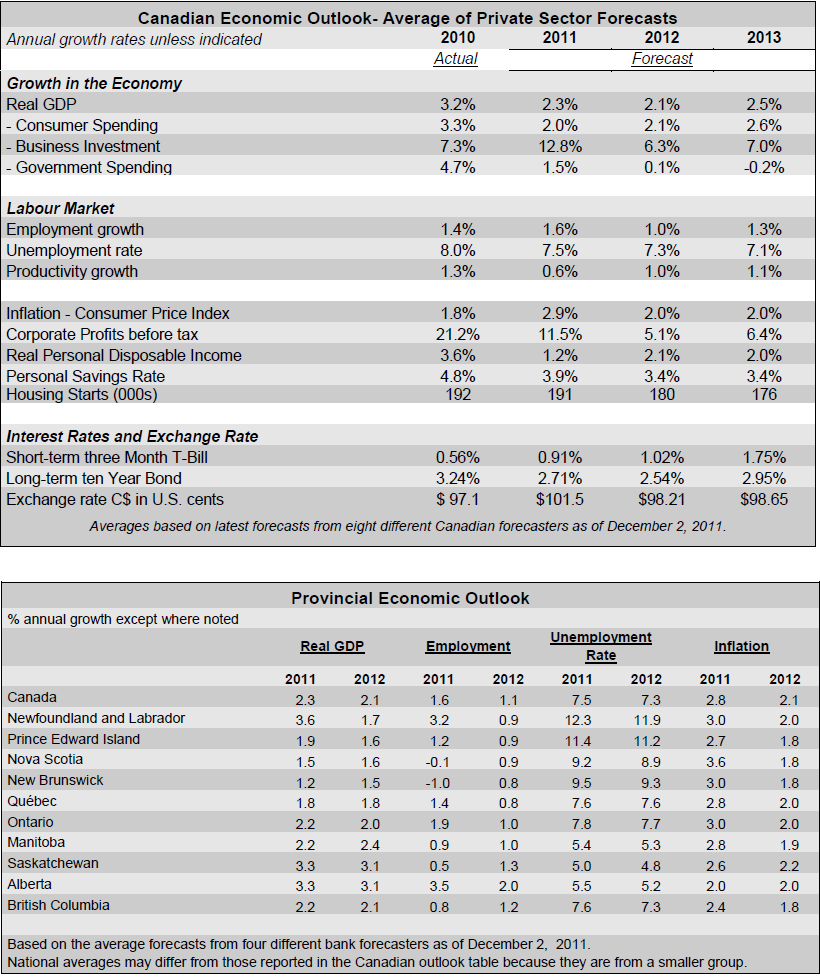

Expect slower rates of economic growth next year, both nationally and in most provinces.

Overall government spending is expected to be flat or decline as a result of misguided austerity measures and public spending cuts.

Employment growth will barely keep up with labour force expansion, leaving the jobless rate high.

Inflation is expected to subside towards 2% with declines or slower increases in fuel, food and housing prices. Interest rates and borrowing costs should remain low for another year.

Canadian and Provincial Economic Forecasts

Labour rights, unions and the 99%

Following attempts by Tea Party Republicans to smash public sector unions in the United States, the fight over labour rights is escalating in Canada.

The federal government has shown little hesitation before siding with employers and imposing back to work legislation and wage settlements on workers, even in private sector labour disputes.

They’ve done this despite evidence that government intervention in collective bargaining leads to higher costs, bitter relations and more strikes in future years.

In Ontario, despite losing the provincial election, Conservative leader Tim Hudak continues to demand the government impose a mandatory wage freeze on public sector workers, limit the power of unions and restrict the ability of arbitrators to award pay increases.

The federal Conservatives also stepped up their attack on unions with a bill that would have eliminated the tax deduction for union dues for unions that don’t provide them with highly detailed disclosures of spending, particularly on advocacy and political activity. This private members’ bill was declared out of order, but could very well be re-introduced by the government. Quebec’s labour minister also introduced similar legislation.

Despite these attacks at the political level, rates of unionization remained stable in Canada during the past year. The number of union members rose to 4.3 million in the first half of 2011, at a slightly higher pace than employment growth. As a result the percentage of paid employees who are members of a union edged up to 29.7% from 29.6% in 2010.

While public sector industries continue to have the highest rates of unionization, there was a decline in union density in public administration, but a notable increase in the percentage of manufacturing and utility workers who are union members. Women make up an increasing share of share of union membership. The unionization rate for women rose to 31.1% while it remained stable for men at 28.2%.

However, rates of unionization are likely to decline in coming years as federal, provincial and municipal governments eliminate public sector jobs through attrition, layoffs and contracting out.

If this happens, it will inevitably lead to growing inequality in Canada.

There’s a clear relationship between unionization and equality. When rates of unionization increase, equality increases. When unionization declines, inequality gets worse—and the share going to the top 1% rises. This relationship is evident in many countries, including Canada (see above) and between provinces.

Greater equality isn’t just important in terms of fairness: it also leads to much better healthier societies for all. There’s a strong relationship between income equality and a wide range of health and social measures, including life expectancy, physical and mental health and crime levels.

And even traditionally free market-oriented organizations such as the International Monetary Fund, the Conference Board of Canada and the OECD now recognize rising rates of inequality are damaging our economic growth.

Unions don’t just increase equality by raising wages and benefits for their own members, they also increase pressure for non-union employers to pay more. Union wage scales provide greater benefits for the lowest paid and limit pay for top executives. Unions also play an important role in creating more equitable social and economic policies for all through advocacy and political activity.

It’s not just 30% of workers who benefit from unions, but also the rest of the 99%.

Canadian economy bleeding jobs; public sector cuts to intensify

Canada’s economy continued to bleed jobs in the past two months, erasing September’s employment gains and pushing the national unemployment rate to 7.4%.

The number of people unemployed in November rose to almost 1.4 million, 60,000 more than in September. This was the largest two-month increase in unemployment since June 2009 when Canada was in the depths of the recession.

If more people hadn’t dropped out of the labour force, unemployment would have increased by 110,000 over the past two months.

While month-to-month changes in Canada’s labour force aren’t very accurate, two consecutive months of job losses totaling 63,000 and a similar increase in unemployment should be a major cause for concern, especially when accompanied by lower rates of participation in the labour force. In comparison, the U.S. economy added a total of over 200,000 jobs in the past two months.

Public sector employment has been particularly weak. It has declined by 0.2% since September and is only 0.4% higher than a year ago.

Statistics Canada’s payroll survey also shows there has been an ongoing decline in public sector employment since last April.

Much of the decline was associated with the layoff of temporary federal workers hired for the 2011 Census, but there was also a drop in the number of people employed by local governments, universities and colleges and local school boards since last April. During the same period there’s been an increase in the number of people employed by provincial governments, health and social services and by government business enterprises, such as utilities.

With governments at the federal, provincial and local level planning to cut jobs through attrition or direct layoffs, there could be an overall decline in the number of public sector workers next year for the first time since 1997.

For example, Toronto Mayor Rob Ford has proposed to cut over 2,300 jobs or 5% of the city’s staff. Ontario Premier Dalton McGuinty pledged to reduce the Ontario public service by 5% or 3,400 full-time-equivalent (FTEs) jobs by April 2012 and recently said another 1,200 job cuts are coming.

Cuts announced in the federal budgets from two years ago are now taking effect, with additional job cuts from more recent budgets to come.

With the private sector job market still weak, cuts in public sector employment will be especially damaging for the economy.

Public sector employment as a share of the total number of people employed has increased in recent years partly because of the decline in private sector jobs, but it is still at a lower rate than it was in any year before 1996.

Forecasters expect no increase in overall government spending in 2012, jobs growth barely keeping up with the expansion of the labour force, and little decline in unemployment rates.

Recession and cuts hit Aboriginal and racialized workers hardest

Inequality damaging economic growth

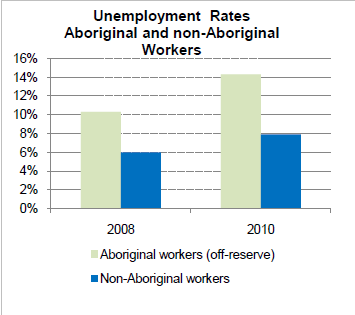

Recently released figures show that the recession and public sector cutbacks are hitting Aboriginal people and racialized workers the hardest.

Not only did Aboriginal workers lose jobs at twice the rate of other workers during the recession, but their rate of job loss accelerated in 2010, while employment levels for other Canadians recovered.

The unemployment rate for Aboriginal people averaged 14.3% in 2010, close to twice the jobless rate for other Canadians. These figures don’t even include First Nations living on reserves or in the northern territories, where unemployment rates are much higher, nor do they include discouraged workers who have given up looking for work.

Including these would put the real unemployment rate for Aboriginal Canadians well over 20%. The latest Census figures available show that the unemployment rate for First Nations people living on reserves was almost twice the rate of those living off-reserve.

There was also a larger increase in the number of Aboriginal people working in part-time and temporary jobs between 2008 and 2010 than for other Canadians.

Most of the job losses for Aboriginal people were among trades, transport and equipment operators, sales and service, manufacturing, processing and utilities.

This was similar to job losses for the rest of the population, but because Aboriginal workers tend to have less seniority on the job, it’s a case of last hired, first fired.

These problems could be magnified if and when governments cutback on public sector jobs. A higher share of Aboriginal people than the general population works in public sector jobs, such as public administration, health care and social assistance.

Aboriginal workers with less seniority could also be the first ones to lose their jobs from public sector job cuts.

Even if job reductions are made just through attrition, the lack of hiring will close opportunities for young Aboriginal Canadians, who represent a much larger share of their population than other Canadians.

While the recession increased unemployment more severely for men and youth, public sector job cuts will likely hurt women more. Women not only make up a majority of public sector workers, but are also more likely to be employed in temporary, part-time and precarious jobs.

The experience of Aboriginal Canadians during the past two years points to failures with governments’ economic stimulus measures in addressing equality concerns.

It’s especially disturbing that basic services, housing and schools in many First Peoples communities remain in poor condition after such an emphasis on infrastructure spending. The $1 billion per year cost of addressing some of economic damages of colonialism through the Kelowna Accord—which was cancelled by Prime Minister Harper—is relatively low compared with the $25 billion spent each year on their economic action plan and additional tax cuts.

While there was some funding targeted for First Nations under the federal government’s economic action plan, there was very little for Aboriginal people living off-reserve.

Not only were almost all the direct jobs created in traditionally male occupations in the private sector, but few appear to have gone to Aboriginal Canadians. We’ll never know the real facts because federal and provincial governments didn’t keep track of the actual jobs created, let alone who was employed.

Except for the new questions on Aboriginal identity Canada’s labour force survey doesn’t collect information on race or ethnic identity for other racialized communities. The only reliable figures for other groups are available through the Census every five years.

However, analysis from the U.S. shows that the black community is also being disproportionately hurt by public sector job cuts, especially at the municipal level and in the broader public sector. For instance, nearly two-thirds of Chicago city employees facing layoffs are African-American.

Many of those who will lose their jobs through Toronto City Mayor Ford’s contracting out of cleaning, garbage collection and other public services are women or from minority groups. These are among the toughest and lowest paid public sector jobs, but they still provide better pay, benefits and security than similar jobs in the private sector.

The loss of these decent jobs is particularly troubling because Aboriginal and racialized workers are already lower paid and under-represented in the workforce.

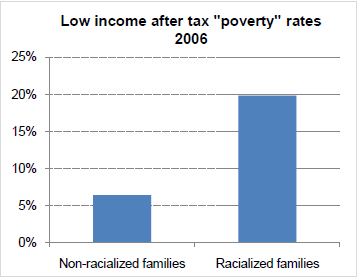

Unemployment rates for most racialized workers are considerably higher and low income poverty rates are at least two or three times the national average, as Sheila Block and Grace-Edward Galabuzi demonstrated in their report on Canada’s Colour-Coded Labour Market.

Public sector cuts are bound to set progress towards greater equality back. Not only are women, low-income and vulnerable families more dependent on public services, but they are more likely to lose their jobs and income through public sector job cuts, contracting out or pay “restraint”.

While equality and human rights should be over-riding concerns, it’s not just Aboriginal Canadians, racialized communities and women who are hurt by inequality.

A recent study calculated the economic benefit of bridging the education gap for Aboriginal people would amount to $90 billion just in Saskatchewan alone. The cost of unemployment and productivity loss for other people not reaching their full potential is far higher.

Unless further progress is made, this is going to become even more of a problem in coming years. As Canada’s population growth slows, visible minorities, recent immigrants and Aboriginal Canadians will make up an increasing share of our labour force and help the economy to maintain growth.

Recent projections by Statistics Canada estimate in twenty years one-third of Canada’s labour force will be foreign born and more than 30% could belong to a visible minority group by 2031. This means we need to make far more progress not only in recognizing foreign credentials, but also in removing barriers to equality.

CUPE and other unions have developed measures and contract language to reduce inequality in the workplace, including employment equity clauses, reducing barriers and responding to the needs of diverse workers. But it is much harder to make progress when cuts are being made and when governments and employers aren’t moving

forward with equality measures themselves.

Now there’s an opportunity to learn from the mistakes of the past. For instance, with plans underway for a new federal infrastructure program, we have an opportunity to not just ensure that more funding goes to greening our communities, but also that it provides jobs and better opportunities for all Canadians.

Inflation target of two percent renewed but expect greater flexibility

After five years of research and considering whether Canada’s inflation target should be lowered or changed, the Bank of Canada renewed its two percent inflation target for at least five more years—but it underlined it will approach this target with greater flexibility.

Canada has had a target of 2% consumer price inflation in effect now for twenty years. It’s been successful at keeping inflation very close to 2% during this time, but it came at the cost of a major recession in the 1990s and disregard of other objectives, such as creating jobs.

Inflation can also have a major impact on redistribution and equality: lower rates of inflation generally benefit those with assets and wealth, low levels of fixed debt, and fixed incomes.

The Bank of Canada originally seemed ready to propose a lower target rate for inflation, but then the financial crisis struck and they realized they needed all the flexibility possible to keep interest rates low.

As the IMF recently suggested, a 4% inflation target would provide greater flexibility for central banks to stimulate the economy. Higher inflation could also provide an easy way to erase some of the build-up of public and household debt.

Interestingly, the Bank of Canada report says that the ideal rate of inflation may be negative because that could help ensure workers share in productivity gains with real wage increases if nominal wages are flat.

One problem is that a single-minded focus on consumer price inflation sidelined concern with house and asset price inflation. This fuelled the financial crisis and led to costs far in excess of marginal benefits of lower consumer price inflation. It’s sobering, but the Bank has also acknowledged that these severe financial crises lead to slower growth and higher unemployment for many years.

But the real problem isn’t monetary policy: historically low interest rates are doing what they can to stimulate the economy.

Instead the problem is with fiscal policies: government spending and tax measures. Canadian governments are cutting public spending and slashing jobs partly to pay for corporate tax cuts. Not only does this increase inequality, but economic analysis shows that tax cuts and particularly corporate income tax cuts have the weakest impact on jobs and economic growth (see above). This means cutting public spending to pay for corporate tax cuts destroys jobs and reduces economic growth.

Inflation Impacts and Outlook

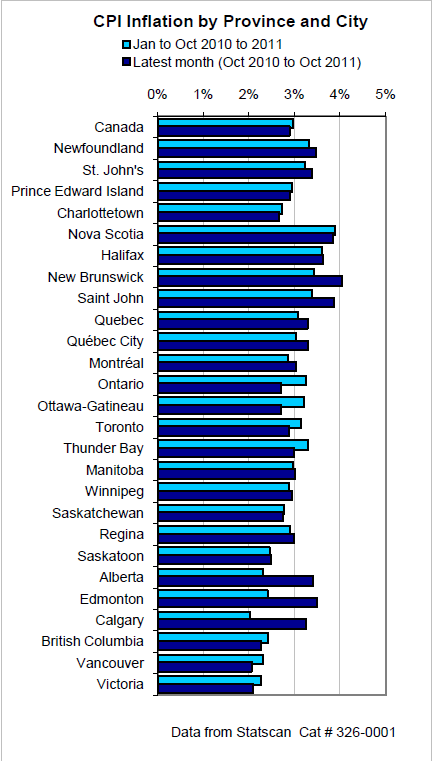

Consumer price inflation increased by 2.9% in the twelve months to October and has averaged 3% higher for the first ten months of 2011.

Inflation has been highest in Atlantic Canada, where October’s rate hit 4% in New Brunswick, 3.9% in Nova Scotia and 3.5% in Newfoundland. British Columbia had the lowest inflation rate at 2.3%.

Most provinces have experienced average inflation of 3% or higher in the year-to-date.

Inflation has increased almost entirely because of higher prices for energy and food.

- Fuel oil prices were 22% higher in October from a year earlier.

- Gasoline prices were 18% higher.

- Food prices were up 4.3%, with food purchased from stores 4.9% higher.

Low and middle-income workers haven’t just experienced smaller wage increases than those at the top, the impact of cost of living increases have also been higher for them.

Low-income households spend over three times the share of their income on food as higher income households and twice as high a share of their income on fuel and energy.

The rate of inflation is expected to decline next year. On average, private bank forecasters forecast the national inflation rate to be 2% in 2012. However, much depends on volatile energy, food and house prices and these forecasts haven’t been very accurate in the past.

Real wages to suffer greatest decline since 1995

Real wages for Canadian workers are on track to decline this year by the most since 1995.

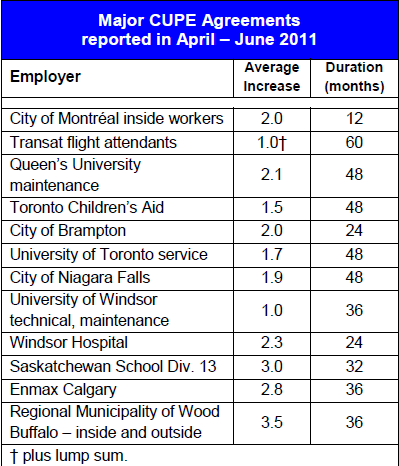

Base wages in major settlements increased by an average of only 1.8% in the first nine months of this year, below the 3% average for consumer price inflation and translating to a 1.2% loss in real wages.

Wages and salaries (and consumer spending) account for 65% of Canada’s GDP. With cuts to public spending, little increase in business investment, and household debt at record rates, there’s little else to keep the economy growing except more crude oil exports—and that won’t flow forever.

Wage increases in public sector settlements have barely increased from last year, averaging 1.7% this year compared to 1.6% in 2010. It’s not just public sector workers who are being squeezed. Wage settlements in the private sector have averaged 2.1% so far this year and declined to 1.9% in the third quarter.

Other measures also show stagnant or declining wages. Average weekly earnings in September were lower than at the start of the year, and only 1.1% higher than a year ago. Hourly wages reported by the labour force survey also increased by only 1.1% in October.

Wage increases were expected to edge up in 2012, but with continued softness in the economy and public spending cuts, they might remain low. Wage settlements for future years of less than the inflation rate, targeted at 2%, will lead to an ongoing erosion of earning power.

Our analysis of wage increases for CUPE members in existing agreements and expectations shows considerable variation by province and sector:

- The good fiscal situation in Newfoundland should provide base wage hikes of 3.5% or higher following expiry of current agreements in April.

- Increases in Alberta and for Local 1000 workers are expected to average 3 Wage increases in Saskatchewan are expected to average ~2.7%. Many agreements continue to provide 3% increases; half of CUPE-SK’s membership should receive better than existing wage increases after the provincial health care agreement expires in March.

- Agreements in Prince Edward Island and New Brunswick are expected to provide increases averaging close to 2.5%

- In Ontario, Quebec and Nova Scotia, existing and new agreements are expected to provide overall average base wage increases of 2% or slightly below. However, increases vary considerably by sector and local. A large share of membership in Ontario is entering difficult bargaining with the City of Toronto and a number of provincial employers.

- In Manitoba and British Columbia, base wages are expected to increase by an average of about 1.5%. Modest wage increases are expected following expiry of the B.C. government’s wage freeze, while in Manitoba, many will continue to be subject to the province’s wage freeze.