There’s a widely held myth promoted by right wing forces and now accepted by many people—that public spending in Canada has increased steeply and is growing at unaffordable and unsustainable rates.

In fact, the opposite is true. The latest figures show that just before the economic crisis total government current spending in Canada was in fact cut to its lowest level as a share of the economy in at least three decades.

The same goes for total government taxes and revenues. As a share of Canada’s economy, by 2008 total government revenues were reduced to their lowest share of Canada’s economy since at least 1981—the furthest back these particular numbers are available.

While more recent figures are not yet available, they are certain to show a spike in recession-related spending. But this spike will be temporary because so much of the stimulus spending was short-term. In the past few years, there’s also been a significant increase in capital infrastructure investment (not included in these figures on current spending) to reduce some of the public infrastructure deficit. Increased support is required to make up for a lack of public infrastructure investment in previous years, but this doesn’t reflect on the sustainability of current public spending. A decline in debt interest costs has helped reduce overall current spending, but that’s only part of the story. Most other major components of government current spending are also at or close to 30 year lows as a share of the economy.

What this shows is that deficits we face weren’t caused by unsustainable rates of public spending. Instead they were caused by the financial and economic crisis over the short-term and declining revenues over the longer term. Squeezing public spending further to pay for the costs of the crisis is not only unfair; it will also inevitably lead to diminished public services.

Members of the public may not feel their tax load is going down. That’s because for most workers one of the few things shrinking more than the public sector is the value of their wages. Corporate profits and top incomes continue to escalate, but little trickles down.

Instead, business lobbyists are using the straitened circumstances of households and misinformation about public sector workers salaries to gain support for cuts to taxes and public spending. This leads to increased costs for households as public services are cut and downward pressure on wages—and an ongoing downward vicious cycle in the standard of living.

For much of the public, their tax load has increased. That’s because there’s been a big shift in our tax system from relying on progressive income and corporate taxes to a more regressive system with reduced taxes on business, high incomes,capital and savings, and increased consumption-based taxes on households.

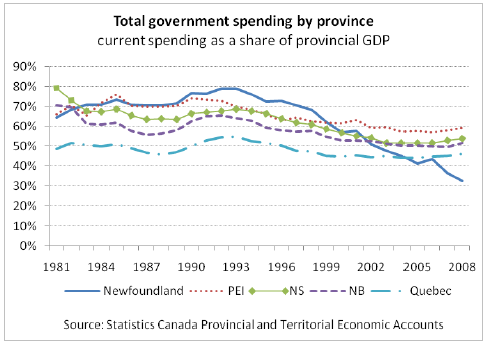

Much has been made about increased spending in some provinces—both by governments and some opposition parties. However, these rates of spending need to be looked at in context. There has also been a big change in responsibility for public services shifting from the federal level to the provincial level.

Harper has increasingly transformed the federal government into an HQ for defence and security and a cheque cashing and clearing agency—and relegating responsibility for the rest to the provinces and to individuals. Federal spending may have increased in recent years, but much of that is defence spending and transfers to the provinces, which are then counted as spending again.

What is relevant is overall net spending. And in virtually every province it’s the same story: total government spending as a share of the provincial economy has recently fallen to a 30-year low.