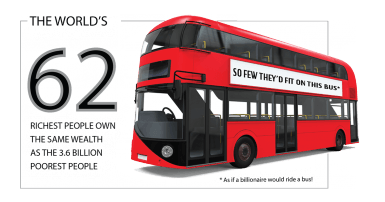

Inequality is quickly becoming even more extreme. The richest 1% now have more wealth than the rest of the world combined, and the 62 wealthiest people have as much as the 3.6 billion poorest people, Oxfam recently calculated.

Economic wealth translates to political power, and the wealthiest have used their influence to change the rules to further increase their wealth and power through privatization, deregulation, trade deals, and tax avoidance. Most of the world’s wealthiest individuals and 90 per cent of the world’s largest companies use tax havens. This tax avoidance isn’t just unfair, it also means many billions less in revenues to support public services in Canada, and especially in poorer countries around the world.

As a priority Oxfam, along with organizations like Canadians for Tax Fairness, is calling for a global tax body that will ensure multinational corporations and the world’s wealthiest pay their fair share.

To close the growing gap for the vast majority, Oxfam is also calling on countries to increase minimum wages towards living wages, strengthen workers’ rights, promote women’s economic rights and end the gender pay gap. Other key demands include accountability and transparency measures to keep the power of the 1% in check, universal access to appropriate and affordable medicine, targeted progressive public spending to tackle inequality, as well as a shift to wealth, capital and income taxes, instead of taxing labour and consumption.

(adapted from Oxfam.ca)