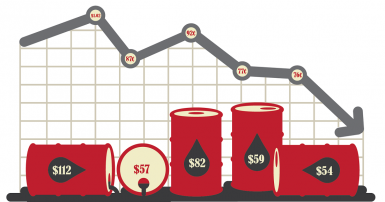

As the price of oil spiked, so did the loonie—and now that the price of oil has plummeted, the Canadian dollar has plunged along with it. About 80 per cent of the changes in the value of the Canadian dollar can be attributed to changes in the price of oil and every 10 per cent change in the price of oil leads to about a three per cent change in the value of the loonie. With the benchmark price of West Texas Intermediate (WTI) oil down by about 50 per cent over the past year, the Canadian dollar has also dropped by about 15 per cent, down to $0.76 USD.

The drop in the value of the Canadian dollar makes our imports more expensive, which is one of the reasons the price of food and other imported goods has increased. The Bank of Canada estimates that the drop in the loonie will add 0.8 percentage points to Consumer Price Index inflation this year.

Despite higher prices for imports, our economy should eventually benefit from a lower dollar because it makes Canadian exports, and particularly manufacturing, more competitive. However it is taking some time for the boost to exports to kick-in because Canada lost so much capacity and manufacturing employment while the dollar was high and it will take years to build it back.

Lessons learned? It’s better to have a diversified economy instead of hitching your wagon to the roller-coaster ride of resource prices.