Sales taxes provide municipalities in many countries with a substantial share of their revenues. While lower-income individuals tend to spend more of their income on goods and services, tax credits and exclusion of basic goods can make sales taxes more progressive. Canadian municipalities currently don’t have the power to levy direct sales taxes.

A better way

In Newfoundland and Labrador, adding one percentage point to the provincial HST and transferring it to municipalities would increase their revenues by an estimated 16 per cent.

Highlights

- Revenues are substantial and grow with the economy

- Works best if upper levels of government set rates, collect, and share the taxes

- Ensures non-residents contribute to their use of municipal infrastructure and services

- Municipalities across Canada are advocating for access to sales tax revenues

How does it work?

How does it work?

Municipalities in other countries generate retail sales tax revenue by either levying a tax themselves, or accessing a share of what other levels of government collect. Retail sales taxes can be costly to administer, especially on a small scale, so harmonized collection provides significant benefits.

Sales tax revenues are drawn from residents and visitors, who both benefit from the municipality’s services and infrastructure.

The regressive nature of the sales tax can be counterbalanced by investing revenues in services and infrastructure that benefit lower- and middle-income residents. Excluding basic or necessary items (like food and child care), and providing credits through the income tax system (such as the GST credit), also help make the impact more progressive.

Who uses it now?

In the United States, about 100 municipalities across 35 states charge a local retail sales tax, with rates ranging from 0.25 per cent to 7.5 per cent. Collection is often harmonized with the state sales tax. Georgia allows local governments to implement a special-purpose local sales tax to fund specific capital projects.

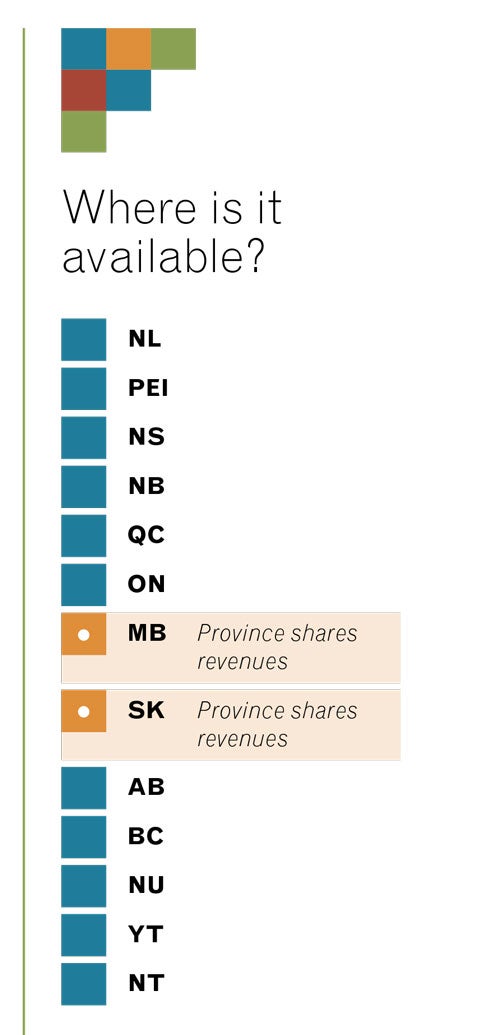

Canadian municipalities don’t currently have the power to levy their own general sales taxes. However, cities and towns in some provinces receive a share of provincial revenues. Saskatchewan shares one percentage point of its retail sales tax revenues, equivalent to over $250 million annually, with municipalities. Manitoba provides municipalities with revenues equivalent to either one percentage point of its sales tax revenues, or a specific combination of income and fuel taxes, whichever is greater.

A number of municipal organizations and other groups have advocated for upper levels of government to dedicate a share of their sales tax revenues to municipalities. One percentage point of the federal GST generates approximately $6 billion. Analysis shows that 80 per cent of Canadian households would be better off if the federal government had transferred one percentage point of the GST to municipalities instead of cutting it.