A fuel tax is charged per litre of fuel. Because lower-and middle-income households generally spend a higher share of their income on fuel than wealthier people, fuel taxes on their own are regressive. But fuel taxes are often used to fund public transit, providing a greater overall benefit to low-income individuals, who are more reliant on transit.

A better way

Metro Vancouver levies a gas tax of 17 cents a litre to help fund the operations of TransLink, its regional transit authority. In 2010, this regional portion of the fuel tax generated more than $323 million.

Highlights

- Currently used in a few major Canadian cities

- Usually funds transportation and other infrastructure

- Fuel use is closely linked to road use, so tax revenues help fund increased municipal spending on roads and transit

- A share of federal gas tax revenue is transferred to municipalities, and some provinces also transfer a share of their fuel taxes to municipalities

How does it work?

How does it work?

Fuel taxes are a specific rate per litre of fuel. They can be levied locally or regionally, or are collected at the federal or provincial level and shared with municipalities based on population or other criteria.

When fuel taxes are levied locally, they usually piggyback onto provincial taxes, and then are transferred to the municipality to reduce administrative costs.

Fuel tax revenue is often specifically earmarked to fund local transit and transportation needs, creating a direct relationship between driving and the infrastructure needed to support it and mitigate its effects.

Who uses it now?

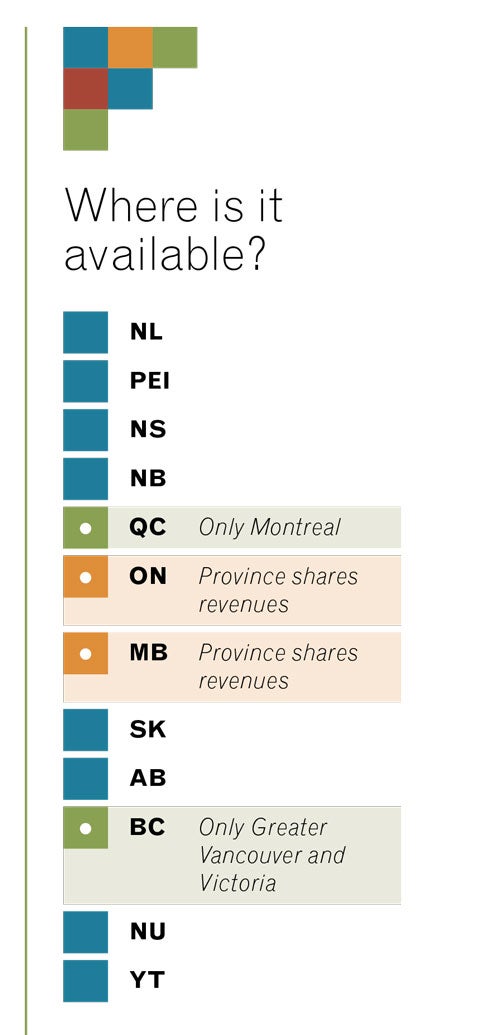

In Canada and the U.S., a few major cities can levy local fuel taxes. Victoria and Montreal both do, and Greater Vancouver levies a regional fuel tax to fund transit. A similar proposal is being considered for the Greater Toronto Area. In Metro Vancouver, fuel tax revenue has successfully been used to fund transit, but has declined as transit services improve and vehicles become more efficient.

While few municipalities can currently collect direct fuel taxes, the federal government and some provinces share fuel tax revenues. The Federal Gas Tax Fund provides $2 billion a year to municipalities, representing revenues approximately equal to half of the 10 cents of federal gas tax charged per litre. These funds are distributed based on population, and can be spent on a broad range of local infrastructure needs.

Provincial gas tax funding provided to Manitoba municipalities through the Building Manitoba Fund is available for a wide range of infrastructure and capital investments, and for transit operating grants. Ontario’s gas tax program provides funding for municipalities with two cents per litre of provincial gas tax to improve and expand transit.