Many people recognize public services are the cornerstones of healthy communities. But public jobs and services play an equally important role in providing a strong foundation for our economy.

High quality schools, child care, health care, libraries, transit, parks, recreation programs, affordable housing, social services and other public services attract people to neighbourhoods. These services build vibrant and healthy communities. They also help people out of poverty, providing everyone with the opportunity to learn, work and prosper.

Public investment pays off

Public services are central to strong long-term economic growth:

- Every dollar invested in public infrastructure provides an annual return of 17 per cent in cost savings to business alone.1

- Every dollar invested in child care pays back an estimated $2.54 in economic benefits to society, including almost a dollar in revenue for governments.2

- Investments in public services are vital to increasing Canada’s economic productivity and competitiveness, and attracting dynamic businesses.3

Public services and public spending are critical in difficult economic times. The stability of public sector jobs and spending sheltered Canadians from the worst of the recession:

- Federal stimulus spending will have created or maintained 220,000 jobs by the end of 2010.4

- If federal and provincial governments had cut spending to balance their budgets in 2009-2010, unemployment across Canada would have almost doubled, leaving at least one million more people jobless.5

Most of the jobs generated by government stimulus spending have been in the private sector. There has been virtually no increase in the number of people working in the public sector since the recession hit. And while public sector workers did not cause the economic crisis, in many cases they are paying for it through layoffs and wage freezes, just as demand for their services increases.

Economic recovery begins with public services

Many municipalities are facing increasing financial pressure. In some communities, local employers shutting down and laying off workers have caused the most immediate problems. The pressure also comes from a longer-term squeeze on municipalities, as they confront limited fiscal powers, cuts to transfers and downloaded responsibilities. Federal and provincial governments have compounded this problem by withdrawing from social programs and shifting the responsibility for a frayed social safety net onto municipalities.6

But it is a mistake for local governments to cut spending. One only needs to look south of the border to see the damage that state and local government budget cuts have caused in the United States. Public spending cuts could short-circuit Canada’s slow and fragile economic recovery and plunge the economy back into recession.

Cutting public services and jobs is a false economy. Cutting one public sector job can lead to the loss of up to four other local jobs, as spending and services in the local economy drops.7 The fallout spreads, as municipal revenues shrink and demand for community services grows, creating another downward economic spiral.

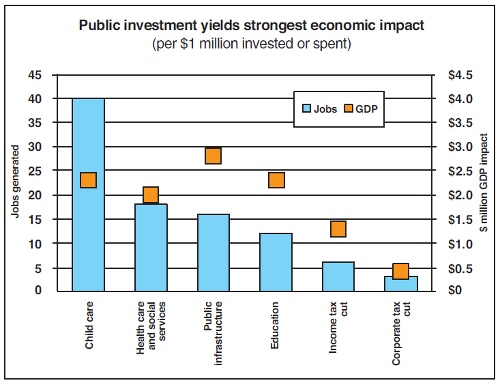

Investing in public services provides a bigger economic boost and creates more jobs than tax cuts. Public services deliver between two and six times the number of jobs compared to equivalent spending on income tax cuts. Public services also deliver higher rates of economic growth (see chart). Measures that benefit low-income households also stimulate the economy.8

When public services are privatized, these economic benefits evaporate. Communities trade stable, decent jobs for lower-paid, often temporary or casual positions. Profits are funneled out of the region.

Contracting out brings little or no cost savings. Municipal governments can save money and boost the local economy by contracting in services and avoiding risky and expensive public-private partnerships.

In the short term, cuts to public services and public sector jobs will only make the situation worse – and that’s something communities cannot afford. There’s a broadening consensus that governments can’t afford more tax cuts either. Ultimately, we will need progressive tax reform and a more equitable sharing of tax revenues between different levels of government to keep our community’s economic and social foundation strong.

1 Statistics Canada. The Impact of Public Infrastructure on Canadian Multifactor Productivity Estimates, 2009.

2 Child Care Human Resources Sector Council. Literature Review of the Socioeconomic Effects and Net Benefits. Summary.

3 World Economic Forum, Global Competitiveness Reports.

4 Federal Budget Plan 2010, p. 285.

5 Combined federal and provincial deficits were an estimated $87 billion in 2009/10. With an average employment multiplier of 15 jobs per $1 million in public spending, this translates to 1.3 million jobs.

6 Federation of Canadian Municipalities, Mending Canada’s frayed social safety net: the role of municipal governments, March 2010.

7 Informetrica Ltd. Review of Ottawa City Budget: Local Impacts due to Service Reductions. December 2007.

8 Federal Budget Plan 2010, p. 281.