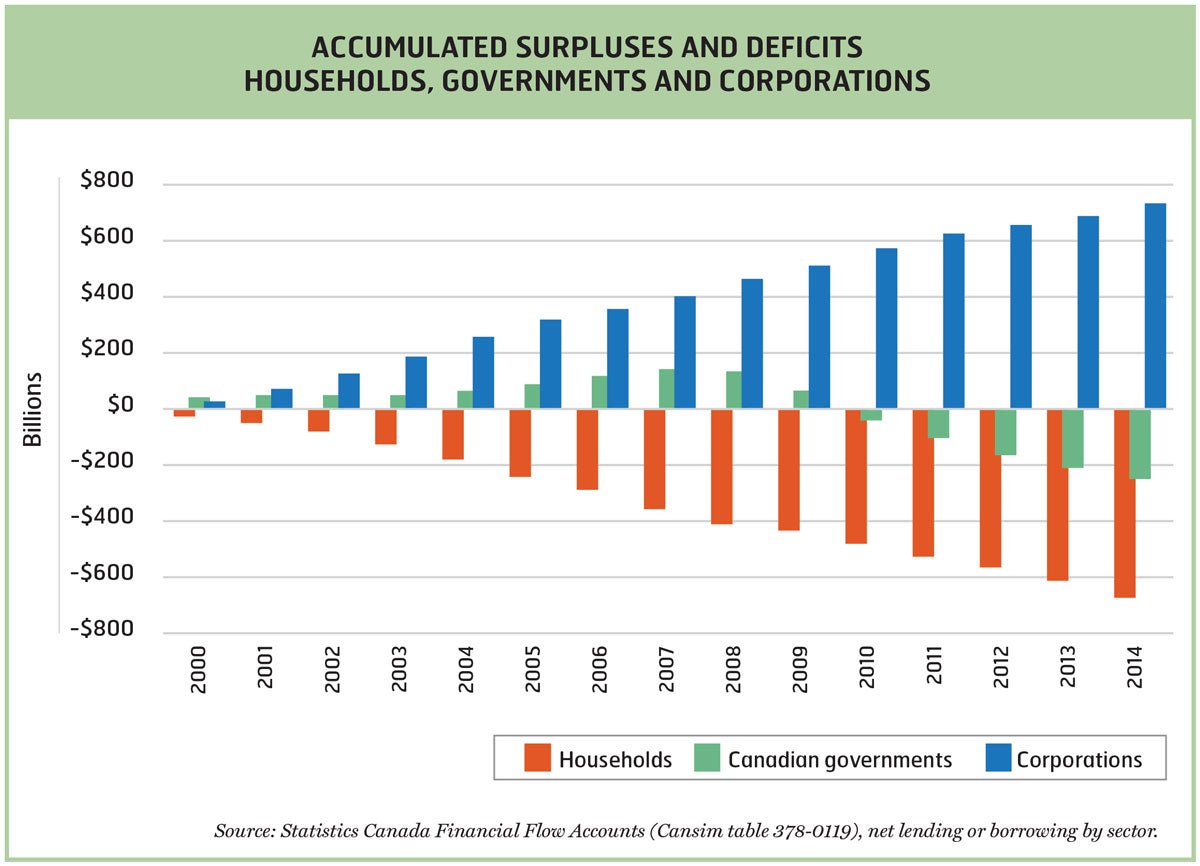

Canadian governments ran surpluses and reduced their overall debts from the late 1990s to 2007, then ran deficits following the economic crisis—although those are now shrinking. Up until the mid-1990s, Canadian households were net lenders to corporations and governments. But with low wage increases and rising house prices, those tables turned and households went further and further into financial debt.

Meanwhile, with high profits and low rates of re-investment, Canadian corporations have racked up large financial surpluses since 2000. In the past 15 years, the surpluses of Canadian corporations have totaled over $700 billion, while households have taken on an additional $660 billion in debt during that same period. These amounts are equivalent to over $50,000 per Canadian household.

What these national balance sheet figures show is that while government deficits and debts get a lot of media attention, what we should really be concerned about is growing household debt and rising corporate surpluses.