Cheryl Stadnichuk | CUPE Research

If your workplace has a cumulative sick leave or short-term disability plan, your employer could qualify for a rebate on the Employment Insurance (EI) premiums it pays to the federal government.

If that is the case, part of the rebate must be directed to the benefit of the employees.

What is the EI rebate?

If an employer provides wage replacement through a workplace short term disability or sick leave program, then workers may not have to access EI benefits during their period of illness.

Therefore, employers with short term disability or sick leave plans can apply for a reduction in the EI premiums they pay. The employer must apply for the rebate, provide documentation of its sick leave plan, and how the employees’ portion of the rebate will be used.

How can the rebate benefit employees?

When an employer applies for an EI premium reduction, it must provide evidence that its employees will benefit “in an amount equal to at least 5/12 of the savings.” Service Canada states that acceptable methods include:

- Cash remittance

- New employee benefits, such as a dental plan, group life insurance,

- free beverages or free social activities

- Increased employee benefits or upgrading of existing benefits

Negotiating a Collective Benefit for the EI Rebate

If your collective agreement is silent on the use of the EI rebate, your employer may still be receiving the premium reduction. Perhaps that Christmas turkey dinner is being funded by the workers’ portion of the EI rebate and not the generosity of the employer.

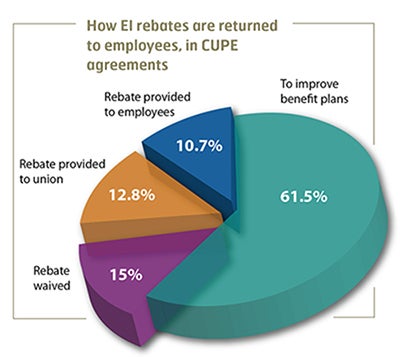

The enhancement of benefits, such as dental coverage or employee assistance plans, is the most commonly negotiated use of the employees’ portion of the EI rebate.

Health care locals in Manitoba and Saskatchewan have negotiated a provincial education and training fund with their pooled employee EI rebate.

Below are a few guidelines to consider when negotiating or reviewing the use of the EI Rebate:

- Ensure that your sick leave plan provides a minimum of 75 accumulated days sick leave for personal use (not family illness).

- Require your employer to annually provide information on the amount generated by the EI rebate and how it was applied. The union should be able to negotiate the allocation of any unused portion of the rebate.

- Require that no changes can be made to the disposition of the employees’ portion of the rebate without mutual agreement.