Pierre-Guy Sylvestre | CUPE Research

Determining members’ wages is a key element of collective bargaining. Here’s some advice to help CUPE locals formulate their wage demands.

Cost-of-living increase

The first factor to consider is the cost-of-living increase. A wage increase that’s below inflation leads to a lower standard of living because workers’ real wages decrease. Therefore, wage increases should at least keep up with the rate of inflation.

The best protection against inflation is an “escalator clause” that automatically raises wages based on the annual averages of the Consumer Price Index.

Since the Bank of Canada targets an inflation rate range of one to three per cent, we can normally expect inflation to be around two per cent per year.

CUPE provides its members with a tool to measure inflation and to check if their wages are keeping up with changing prices. Find it at cupe.ca/cpi-calculator.

Real wage increases

Beyond protections for increases in the cost of living, workers also deserve real wage increases because economic growth tends to be positive over the long term. Workers should therefore benefit from this growth that they help create by obtaining fair, equitable wage increases that are above the rate of inflation. The moment total wage increase exceeds inflation, we call it a real wage increase.

Wage parity

Some CUPE members have low wage levels compared to other, similar groups. For example, the wages of members of a newly unionized group might be lower than other employees in the same sector who’ve been unionized longer. Ideally, the local should try to eliminate this gap with its first collective agreement.

Achieving parity requires wage comparisons between similar-sized organizations in the same sector. In the municipal sector, locals should calculate the average wages of employees in similar-sized towns based on their collective agreements.

Once the value of parity is determined, locals must negotiate the time period to achieve it with the employer.

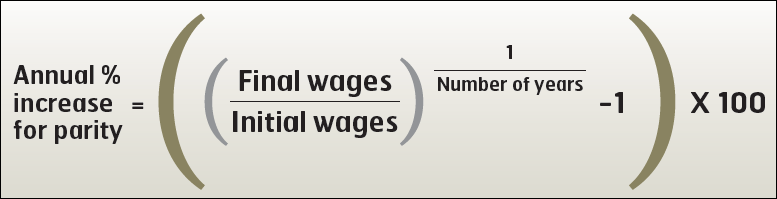

Fortunately, there is a formula to determine the annual percentage required for wages to catch up: divide the final wages by the initial wages, multiply to the power of 1 over the number of years set out for catch-up wages, minus 1, and then multiply by 100:

In the next edition of Tabletalk, we will explain how to assess multiple employer wage offers and rate them.